Welcome to the world of Education First Federal Credit Union, where financial empowerment meets personalized service. Whether you’re a student embarking on your educational journey or a homeowner looking to secure your dream space, this credit union is dedicated to helping you thrive. With tailored solutions and member-focused programs, Education First FCU stands out as an invaluable resource for achieving financial success. Join us as we explore how your membership can unlock opportunities that lead to greater stability and prosperity in every aspect of life.

“Education First Federal Credit Union” Blog Article Outline

Education First Federal Credit Union offers a unique approach to financial wellness. With an emphasis on education and quality service, members can navigate their financial journey with confidence.

From smart financing options for higher education to exclusive discounts, the credit union prioritizes its members’ needs. They also celebrate cultural milestones like Black History Month while providing essential tips for safe online shopping and insights into home inspection processes. Each aspect of membership is designed to foster growth and security in your financial future.

Leveraging Credit Union Membership for Financial Success

Membership at Education First Federal Credit Union opens doors to a variety of financial opportunities. By taking advantage of lower interest rates and personalized service, members can significantly improve their financial health.

Credit unions often prioritize education and community support, empowering members with the knowledge they need for sound financial decisions. With tools like budgeting workshops and tailored loan options, individuals are better equipped to achieve their goals and secure a stable future.

Enhancing Financial Position Through Education and Quality Service

At Education First Federal Credit Union, we believe that knowledge is power. Our commitment to educating members about financial options empowers them to make informed decisions. We offer workshop and resources covering everything from budgeting basics to investment strategies.

Quality service complements this education, ensuring personalized support for every member’s unique situation. Our dedicated team guides you through the intricacies of banking with a friendly approach. This combination of education and exceptional service paves the way for improved financial health and confidence in your future.

Smart Financing for Higher Education

Investing in higher education is crucial, and smart financing can make all the difference. Education First Federal Credit Union offers tailored loan options designed to fit your budget and financial goals. With competitive rates, you can focus more on learning rather than worrying about costs.

Additionally, members gain access to useful resources that help navigate student loans effectively. From budgeting tips to personalized advice, the right support can empower your educational journey without breaking the bank.

Exclusive Discounts and Savings for Members

Members of Education First Federal Credit Union enjoy a variety of exclusive discounts and savings opportunities. From reduced rates on loans to special offers with local businesses, these perks enhance financial well-being.

Whether you’re purchasing a new car or planning a vacation, the benefits can add up quickly. Members are encouraged to explore available promotions regularly, ensuring they maximize their membership advantages while saving money in the process.

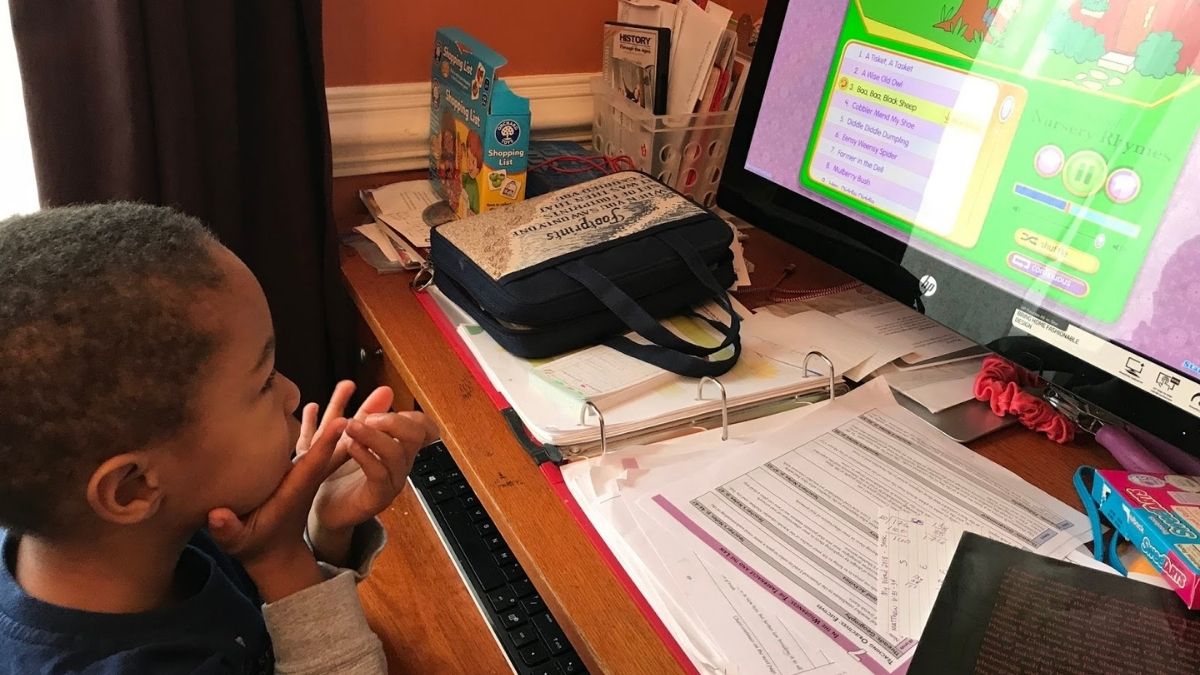

Celebrating Black History Month

Black History Month is a time to honor the achievements and contributions of African Americans throughout history. At Education First Federal Credit Union, we stand together in recognizing the impact of trailblazers who have shaped our society.

This month invites us all to reflect on stories of resilience and innovation. We celebrate diversity and commit to fostering inclusion within our community, ensuring that every member’s voice is valued and heard. Together, we can create a brighter future for everyone.

Acing the Home Inspection Process

Navigating the home inspection process can feel overwhelming, but it’s an essential step in buying a home. Start by choosing a trusted inspector who knows your area well. Ask questions and get clarity on their findings.

Once you receive the report, review it thoroughly. Pay attention to major issues that could affect safety or finances. Use this opportunity to negotiate repairs or price adjustments with the seller for your peace of mind as you move forward with your new investment.

Tips for Safe Online Shopping

Online shopping offers convenience, but safety should always come first. Use secure websites with “https://” in their URLs. This ensures your personal information remains protected during transactions.

Avoid using public Wi-Fi for purchases, as it can expose you to potential risks. Always check for customer reviews and ratings before making a purchase. Additionally, utilize strong passwords and enable two-factor authentication whenever possible to further safeguard your accounts while enjoying the ease of online shopping.

Banking Anytime, Anywhere

With the rise of technology, banking has never been more accessible. Education First Federal Credit Union offers members the convenience of managing their finances from anywhere at any time. Whether you’re at home or on the go, your account is just a few taps away.

Mobile and online banking features empower users to check balances, transfer funds, and pay bills effortlessly. This flexibility allows you to stay in control of your finances without being tied to traditional bank hours or locations.

Member Testimonials and Reviews

Members of Education First Federal Credit Union often share their positive experiences. Many highlight the personalized service they receive, which sets it apart from traditional banks.

From easier loan processes to friendly staff, these testimonials reflect a commitment to community and support. Members appreciate how their needs are prioritized, fostering trust and loyalty within the credit union family. The feedback consistently showcases a strong sense of belonging among members, reinforcing why many choose Education First FCU for their financial journey.

Mobile App Features and Support

Education First Federal Credit Union offers a user-friendly mobile app that puts banking at your fingertips. With features like easy fund transfers, account balances, and transaction history, managing your finances has never been simpler.

Support is readily available through the app as well. Members can access FAQs and get assistance with any issues they may encounter. This ensures a smooth experience while navigating their financial journey anytime and anywhere.

About Education First FCU

Education First Federal Credit Union is a member-focused financial institution dedicated to serving the needs of its community. With a commitment to education and growth, they provide personalized services tailored to each member’s unique situation.

Founded with the intention of promoting financial literacy, Education First FCU offers various products ranging from savings accounts to loans. Their goal is simple: empower members through knowledge and quality service while fostering solid relationships built on trust and support.

Branches and ATM Locations

Education First Federal Credit Union offers a network of branches and ATMs designed to serve members conveniently. Whether you’re looking for personal assistance or need cash on the go, finding a location near you is easy.

With several branches across the area, help is always within reach. Plus, their extensive ATM network ensures that accessing funds doesn’t require long trips or extra fees. Enjoy banking flexibility wherever life takes you with Education First FCU’s locations!

Support and Contact Information

For any inquiries or assistance, Education First Federal Credit Union is here to help. You can reach out through their website for quick access to support services. If you prefer a personal touch, visit one of their friendly branches or call the customer service line during business hours.

The dedicated team ensures that all your questions are answered promptly and effectively. Whether it’s about membership benefits, account management, or any other concerns, they are ready to assist you on your financial journey. Don’t hesitate to get in touch and experience the exceptional member service that sets Education First FCU apart!